the butterfly effect – reaching new heights for European, nimble software companies.

After having both built but also helped many others build their software companies, with no money, our own money, VC money, PE money, targeting horizontal spaces as well as particular vertical industries, we are utterly convinced there is a better way to scale businesses. Thus began the Papillon way.

Europe has tens of thousands (we have built a unique database) of software companies. Some of these companies target large markets and will attract VC money, and attempt a hockey stick approach to growth. Some companies will grow into the territory where they will receive daily or weekly emails from PE companies and software aggregators with a need to deploy their money. This is -not- the Papillon way.

Instead, Papillon Software will build, market and sell software with the long run in mind. We focus all of our efforts on solving clients’ real needs in particular markets, and through an attractive, sustainable, long-term ownership model, everyone benefits. We do not sell our companies, we invest in people, we build for the long run. That’s the Papillon way. Very European, and extremely successful.

Founder & Chairman

Software may run the world, but people build software companies.

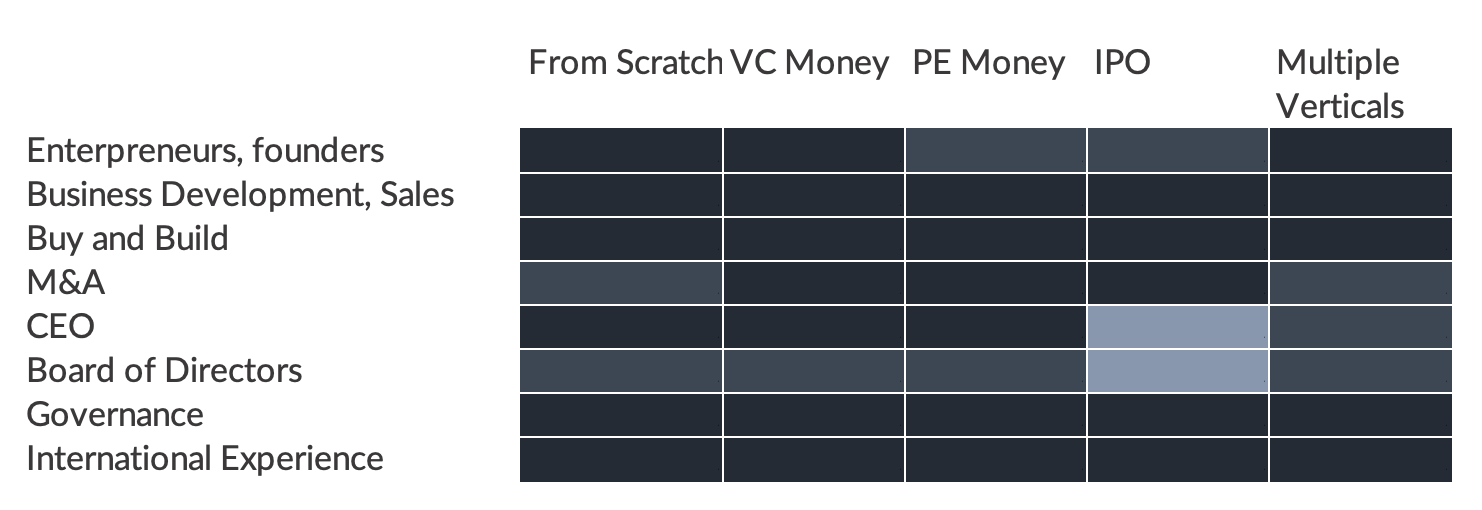

Papillon’s leadership team has:

- Built several software companies with combined market cap of several hundred million Euros through 3 IPOs and private exits.

- Built B2B revenues from 0 to combined 100M+EUR. Delivered sales on most continents across 10+ verticals.

- 20+ international M&A deals, all successfully integrated

- Built a network that spans the globe and well into the upper echelons of world’s largest companies

We have been entrepreneurs our entire working life.

So, why build Papillon?

We believe that for very many companies, where VC and PE is not a good fit,there is a need for a better model. Papillon enables our investors to rely on us to acquire and invest in companies and people, and unlike VC & PE, focus only onlong-term sunstainable growth and active development – without aiming for hasty exits that destroy people’s motivation and shareholder values.

If you take into account what we are building together with dozens of entrepreneurs, it quickly becomes clear what sort of competency and experience that Papillon’s leadership team need to possess. Like the founders and management teams we work with, we have been in their shoes many times. Unlike most of them, this team has worked extensively with professional investors, listed companies and built to scale. Ultimately, all of this comes down to deep and long-term commitment and attention to people.

Diderich Buch

Founder, Chairman

Morten Kvam

Co-founder, Director

Olav A. Djupvik

Co-founder, director

Runar Rønningen

Director Capital Markets, M&A

To be announced

Co-founder, Director of Growth